Search Market Research Report

Credit Management Software Market Size, Share Global Analysis Report, 2022 – 2028

Credit Management Software Market Size, Share, Growth Analysis Report By Deployment Model (On-Premise, Cloud), By Enterprise Size (Large Enterprise, Small & Medium Enterprises), By Industry Vertical (BFSI, Health Care, Retail, IT & Telecommunication, Government, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

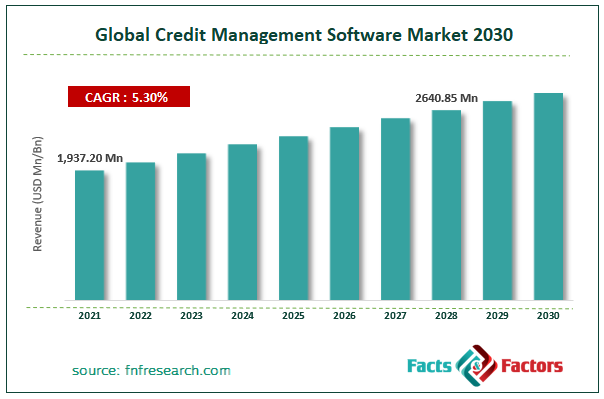

[222+ Pages Report] According to Facts and Factors, the global credit management software market size was worth USD 1,937.20 million in 2021 and is estimated to grow to USD 2,640.85 million by 2028, with a compound annual growth rate (CAGR) of approximately 5.30% over the forecast period. The report analyzes the credit management software market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the credit management software market.

Market Overview

Market Overview

Credit management software prioritizes and automates the credit management process. Along with helping with various daily tasks performed by team members of the credit management department, it also aids in storing crucial data. Additionally, it aids in the accurate recording of invoices and the management of cash flow in businesses. Credit management software can also be integrated into many different aspects of a business or used as a part of other software. As a result, firms from several industries are becoming more interested in credit management software, which is expected to drive the market's growth over the coming years. The benefits provided by credit management software, including improved cash flow management, maximum consumer behavior insights, and many others, drive demand for credit management software over the predicted period.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic caused a disastrous market decrease for most businesses. Still, it had a favorable effect on the credit management software sector because lockdowns were imposed by governments in the affected nations, forcing people to use online payment methods. Due to the increased technology adoption, the credit management software market is anticipated to expand significantly during the COVID-19 crisis. This is related to the widespread fear of viruses and the desire to avoid direct human contact, which contributes to halting the spread of COVID-19.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global credit management software market value is expected to grow at a CAGR of 5.30% over the forecast period.

- In terms of revenue, the global credit management software market size was valued at around USD 1,937.20 million in 2021 and is projected to reach USD 2,640.85 million by 2028.

- The benefits provided by credit management software, including improved cash flow management, maximum consumer behavior insights, and many others, drive demand for credit management software over the predicted period.

- By deployment model, the cloud category dominated the market in 2021.

- By industry vertical, the BFSI category dominated the market in 2021.

- Europe dominated the global credit management software market in 2021.

Growth Drivers

Growth Drivers

- The rise in awareness about automation in credit management activities drives the market growth

The global credit management software market is expected to grow faster than expected over the projected period due to a rise in awareness of the benefits of automation and specialized software. Along with these advantages, the product provides superior cash flow management and enhanced consumer behavior data. The telecom, information technology, manufacturing, electronics, and healthcare industries use credit management software extensively. The software also has applications in enterprise resource management and performs a synergistic function. Its interface with ERP helps the firm handle resources and transactions more effectively.

Restraints

Restraints

- Opposing regulations and business protocols may hinder the market growth

The time and operating costs involved with the trade are rising because of conflicting legislation and business practices and basic barriers such as language and currency. In consequence, it is anticipated that this will impede market expansion. However, high product costs may slow the market's expansion over the projection period.

Opportunities

Opportunities

- Rising international trade presents market opportunities

As the need for automation in the sector has increased over time, credit management software has been developed to prioritize and streamline credit management procedures. Credit management software is advantageous to businesses because it enables them to receive payments more quickly and gain time to enhance customer care and communication. Additionally, the program maintains important data and executes/sets up several daily operations that the credit management team is expected to carry out.

Segmentation Analysis

Segmentation Analysis

The global credit management software market has been segmented into deployment model, enterprise size, industry vertical, and region.

Based on the deployment model, the credit management software market is segregated into on-premises and cloud. Among these, the cloud segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Its user-friendly feature and capacity to provide remote access to the credit management software are acknowledged for the segmental growth during the anticipated period. The software's cloud-based deployment facilitates collaborative workflow, data aggregation, and simply storing and retrieving information from any location.

Based on enterprise size, the credit management software market is segregated into large enterprises and small & medium enterprises. Among these, the large enterprise segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Credit management software is more reasonable for large businesses while being expensive. Additionally, some enormous consulting firms assist smaller businesses in managing their credit accounts by relying on credit management software. The popularity and usage of credit management tools are rising, benefiting medium-sized businesses.

Based on industry vertical, the credit management software market is segmented into BFSI, healthcare, retail, IT & telecommunication, government, and others. Among these, the BFSI segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Numerous financial-related tasks, including account administration, risk analysis, payment processing, credit card reconciliation, and others, are carried out using banking applications. Banking firms use this software to manage customer accounts, including their property holdings, financial data, and transactions. With full visibility of activity across numerous products or services a bank or financial institution provides, these banking systems allow a company to centralize all transactional data relating to customers' accounts in one location.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1,937.20 Million |

Projected Market Size in 2028 |

USD 2,640.85 Million |

CAGR Growth Rate |

5.30% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

CreditDevice, Esker SA, Onguard BV, Credica Ltd, Rimilia Holdings Ltd, Finastra, Equinity Group Plc, HighRadius Corporation, Cforia Software Inc, Serrala Group GmbH, and Others |

Key Segment |

By Deployment Model, Enterprise Size, Industry Vertical, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Europe dominated the credit management software market in 2021

In 2021, Europe dominated the global credit management software market. The significant presence of small and medium-sized businesses in nations like Germany, France, the UK, and Italy is attributed to driving regional market expansion during the forecast period. Furthermore, the product is now more widely accepted by reputable businesses in the area due to the strong enforcement of the regulations governing credit management activities. Over the past ten years, significant industrialization brought on by large-scale foreign investment due to cheap labor has increased the adoption of credit management software across various organizations.

Competitive Landscape

Competitive Landscape

- CreditDevice

- Esker SA

- Onguard BV

- Credica Ltd

- Rimilia Holdings Ltd

- Finastra

- Equinity Group Plc

- HighRadius Corporation

- Cforia Software Inc

- Serrala Group GmbH.

Global Credit Management Software Market is segmented as follows:

By Deployment Model

By Deployment Model

- On-Premise

- Cloud

By Enterprise Size

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprises

By Industry Vertical

By Industry Vertical

- BFSI

- Healthcare

- Retail

- IT & Telecommunication

- Government

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- CreditDevice

- Esker SA

- Onguard BV

- Credica Ltd

- Rimilia Holdings Ltd

- Finastra

- Equinity Group Plc

- HighRadius Corporation

- Cforia Software Inc

- Serrala Group GmbH.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors