Search Market Research Report

Neo and Challenger Bank Market

Neo and Challenger Bank Market Size, Share, Growth Analysis Report By Service Type (Loans, Mobile Banking, Checking & Savings Account, Payment & Money Transfer, and Others) and End User (Business and Personal), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

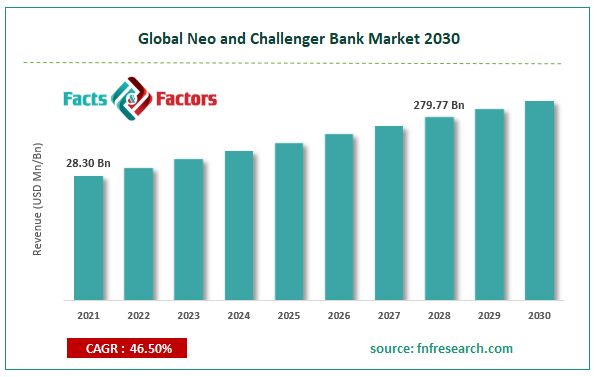

[202+ Pages Report] According to Facts and Factors, The global neo and challenger bank market size was worth USD 28.30 billion in 2021 and is estimated to grow to USD 279.77 billion by 2028, with a compound annual growth rate (CAGR) of approximately 46.50% over the forecast period. The report analyzes the global neo and challenger bank market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the global neo and challenger bank market.

Market Overview

Market Overview

Challenger banks are reputable companies with complete banking licenses that operate in the market. These financial institutions provide a range of services, such as lending, credit cards, checking and merchant accounts, savings and investment accounts, and mobile banking (retirement savings, insurance products, and buying & selling of cryptocurrency). These banks continually threaten the established traditional banks by incorporating various technology into their product offerings. Moreover, neobank is a completely online bank that operates under a partnered bank license and has no physical locations. These banks do business through mobile applications that cover loans, checking and savings accounts, insurance, mortgages, and digital and mobile-first financial payment solutions.

Neobanks provide value-added services to businesses, especially small and medium-sized ones, such as automated accounting, cost management, and payroll. Therefore, to compete with the market's dominant traditional banks, neo and challenger banks have teamed up to enter the banking industry with cutting-edge features, real-time services, and customer-centric products & services. The main market drivers are higher interest rates offered to consumers compared to traditional banks, government & regulatory support for banking activities, and increased convenience provided by mobile applications. However, the costs associated with acquiring online clients and the profitability of these start-up banks limit the market's growth.

COVID-19 Impact:

COVID-19 Impact:

Due to the increase in end users choosing neo and challenger bank solutions tools during the COVID-19 epidemic, COVID-19 had a favorable effect on the neo and challenger bank market. Due to the rigorous lockdowns and social isolation implemented to stop the virus's spread, these banks' services, such as payment and money transfer, checking and savings accounts, and mobile banking, were noticed. Due to the increased public knowledge of the potential advantages of neo and challenger banks, the market for these financial institutions is anticipated to expand rapidly in the post-pandemic environment.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global Neo and challenger bank market value to grow at a CAGR of 46.50% over the forecast period.

- In terms of revenue, the global neo and challenger bank market size was valued at around USD 28.30 billion in 2021 and is projected to reach USD 279.77 billion by 2028.

- Convenience offerings of banking services to businesses and better interest rates over traditional banks, approvals and granting of banking licenses by financial authorities across the globe are the major factors driving the market's growth.

- By service type, the loan category dominated the market in 2021.

- By end user, the business category dominated the market in 2021.

- North America dominated the global neo and challenger bank market in 2021.

Growth Drivers

Growth Drivers

- Advanced features and higher interest rates over conventional banks to drive market growth

Challenger banks and neo to compete with the market's established conventional banks, the market has joined forces to enter the banking business with cutting-edge features, real-time apps, and client-centric products and services. The market's main drivers are higher interest rates than traditional banks, government and regulatory backing for banking activities, and improved convenience offered by mobile apps.

Restraints

Restraints

- Limited everyday transactions hinder the market growth

Neobanks and challenger banks only provide basic transaction and savings accounts as far as banking products go, which is projected to operate as a brake on the neo-banking sector.

Opportunity

Opportunity

- Expansion and product offerings to present market opportunities

Challenger and Neo Bank It is anticipated that this market category would present profitable growth opportunities, such as enhancing internet services for the unbanked population in emerging economies. In the upcoming years, these Fintech banks will continue to focus on growing their markets, product bundling, establishing banking portfolio expansion, and providing tailored solutions.

Segmentation Analysis

Segmentation Analysis

Service type and end-user are the two market segments for the global neo and challenger bank market.

According to the type of service offered, the market can be classified into five categories: loans, mobile banking, checking and savings accounts, payments and money transfers, and others. In terms of service type, the loan segment led the neo and challenger bank market, which is projected to do so during the forecast period. Faster loan approval and funding compared to traditional banks, as well as low or no banking fees through banking applications, are driving the growth of the lending segment in the market. Additionally, it is predicted that the market for payments and money transfers will grow at a large CAGR during the projection period.

The market is divided into Business and Personal segments based on the end user. Based on offending users, the business category formerly dominated the Neo and challenger bank market and is projected to do so over the forecast period. The expansion of the business segment is anticipated to be driven by an increase in the adoption of mobile & digital banking by major corporations and small and medium-sized enterprises (SMEs) for the execution of payment methods over the projected period. Additionally, a sizable CAGR growth is predicted for the personal category during the forecast period. The growth of the neo and challenger banking sectors was primarily fuelled by the ease of quick transfers, lower banking fees, and customized services.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 28.30 Billion |

Projected Market Size in 2028 |

USD 279.77 Billion |

CAGR Growth Rate |

46.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Atom Bank plc, Fidor Solutions AG, Monzo Bank Limited, Movencorp Inc., MYbank, Number26 GmbH, Simple Finance Technology Corporation, Tandem Bank, UBank Limited, WeBank, and Others |

Key Segment |

By Service Type, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- In July 2021, Monzo unveiled new services created due to its collaboration with Wise to offer its users an easy, affordable option to send money abroad. Never employ hidden fees and always use the actual exchange rate.

- In September 2020, Sopra Steria, a pioneer in digital transformation in Europe, completed purchasing 94.03 percent of the share capital of Sodifrance. Two press statements published on February 21 and July 9, 2020, disclosed the acquisition intention for Sodifrance.

- Sopra Steria completed the acquisition of Fidor Solutions, the software division and digital banking expert of next-generation bank Fidor Bank, on December 31, via its subsidiary Sopra Banking Software, for completion in January 2021.

Regional Landscape

Regional Landscape

- North America dominated the Neo and challenger bank market in 2021

Based on regional analysis, the Global Neo and Challenger Bank Market is segmented into the following four regions: North America, Europe, Asia Pacific, and the Rest of the World. North America is expected to hold the largest market share during the predicted period. Because of significant participants like Atom Bank plc and Fidor Solutions AG, the industry will grow as new technologies are incorporated into the product line. Increased company R&D spending would result in a wider regional market expansion.

Competitive Landscape

Competitive Landscape

- Atom Bank plc

- Fidor Solutions AG

- Monzo Bank Limited

- Movencorp Inc.

- MYbank

- Number26 GmbH

- Simple Finance Technology Corporation

- Tandem Bank

- UBank Limited

- WeBank

Neo and Challenger Bank Market is segmented as follows:

By Service Type

By Service Type

- Loans

- Mobile Banking

- Checking & Savings Account

- Payment & Money Transfer

- Others

By End User

By End User

- Business

- Personal

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Atom Bank plc

- Fidor Solutions AG

- Monzo Bank Limited

- Movencorp Inc.

- MYbank

- Number26 GmbH

- Simple Finance Technology Corporation

- Tandem Bank

- UBank Limited

- WeBank

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors