Search Market Research Report

System in Package (SiP) Technology MarketSize, Share Global Analysis Report, 2022 – 2028

System in Package (SiP) Technology Market Size, Share, Growth Analysis Report By Packaging Technology (2D IC Packaging, 2.5D IC Packaging, and 3D IC Packaging), By Packaging Method (Wire Bond and Flip Chip), By End-User (Consumer Electronics, Automotive, Telecommunication, Industrial Systems, Aerospace and Defense, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

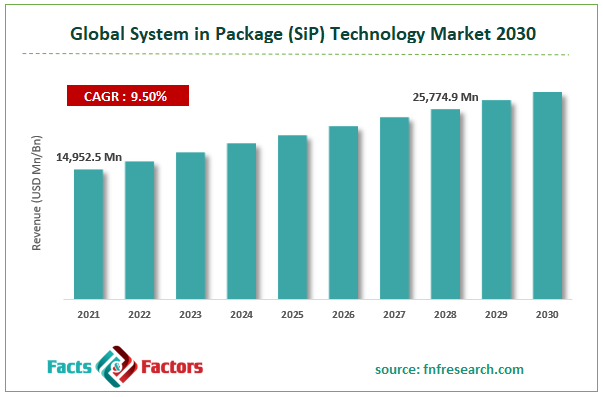

[210+ Pages Report] According to Facts and Factors, the global system in package (SiP) technology market size was worth USD 14,952.5 million in 2021 and is estimated to grow to USD 25,774.9 million by 2028, with a compound annual growth rate (CAGR) of approximately 9.5% over the forecast period. The report analyzes the system in package (SiP) technology market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the system in the package sip technology market.

Market Overview

Market Overview

Multiple dies can be incorporated into a single module to the packaging technique known as a system in package (SiP). Multiple integrated circuits are combined into one tiny package, thus reducing the price of designing and putting together a printed circuit board (PCB). Using standard off-chip wire bonds or solder bumps, SiP may be stacked vertically or tiled horizontally. SiP is widely employed in many industries, including consumer electronics, automotive, and telecommunications, because of its improved efficiency and durability. The conventional system on a chip (SoC) integrated circuit architecture combines components based on function onto a single circuit die. SiPs are in contrast to this.

The growing adoption of internet of things (IoT) technologies and related systems, improvements like microelectronic devices, and an increase in the use of graphics cards and processors for real-world gaming applications are some of the key factors driving the global system in package (SiP) technology market. On the other hand, the high initial investment costs associated with adopting these technologies could limit the growth of the global system in package (SiP) technology market in the ensuing years. However, throughout the forecast period, predictions for the worldwide system in package (SiP) technology market are expected to benefit from the growing demand for efficient high-frequency electronics and gadgets.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic problem that spread over the world, originating in China, hindered the semiconductor sector and the economic development of practically every nation. As a result of the facilities remaining closed for a while, the manufacturing industry has been severely impacted. Sales of various industrial goods, including electronics, automobiles, and others, are declining. With the customer's absence, businesses, public spaces, schools, and other locations remained closed.

The demand for electronics components has decreased across the board from businesses and consumers, and the microelectronics revenue model has suffered because no mass manufacture of these products took place during the lockdown. After the shutdown, the semiconductor sector began to reclaim market share as production facilities resumed operations while taking precautions against societal alienation. The market growth was accelerated by the rising demand for tiny form factor electronics devices, particularly smartphones and health monitoring.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global system in package (SiP) technology market value is expected to grow at a CAGR of 9.5% over the forecast period.

- In terms of revenue, the global system in package (SiP) technology market size was valued at around USD 14,952.5 million in 2021 and is projected to reach USD 25,774.9 million by 2028.

- The growth of the portable electronics industry, the popularity of the Internet of Things, and the demand for circuit miniaturization in microelectronic devices are the main drivers influencing the system in package (SiP) technology market.

- By packaging technology, the 2.5D IC packaging category dominated the market in 2021.

- By end-users, the automotive category dominated the market in 2021.

- The Asia Pacific dominated the global system in the package sip technology market in 2021.

Growth Drivers

Growth Drivers

- An increasing need for electrical device miniaturization will promote the market growth

Rapid technological advancement and research have generated a demand for dependable and small electronic equipment. As a result, demand for miniature electrical devices is rising. With the evolution of semiconductor technology, many electronic goods have evolved, necessitating the employment of IC packaging technology in logic, memory, RF, and sensors to be integrated into compact form factors. Smaller-footprint solutions with excellent performance and low power consumption are available using SiP. Additionally, the shorter wire length in SiP contributes to improved circuit performance and lower power consumption by regulating cycle time and energy dissipation. The SiP technique makes it easier to integrate various multichip modules—like DRAM and others—together with the least amount of interference. This system in the packaging market is expanding due to the growing usage of IC packaging technology in small form factors for creating miniaturized electronic devices.

Restraints

Restraints

- Increased integration causes thermal problems which may restrict the market growth

Per unit footprint, SiP allows extremely dense multilayer integration. Although many applications where miniaturization is an issue find this appealing, it also poses problems for heat control. High on-chip temperatures are caused by increased integration. An overheating problem might be seen while producing 3D ICs using TSVs. Increased temperature causes the threshold voltage to decrease and mobility to deteriorate. Since metal makes up most of the components, the resistance and power loss rise. Additionally, the wire resistance rises, causing longer connection delays. Higher power densities and increased thermal resistance along heat dissipation channels are the leading causes of the more noticeable thermal impacts in 3D IC. As a result, thermal problems impede technology development in the packaging market.

Opportunity

Opportunity

- Utilization of RF components in the construction of cutting-edge 5G infrastructure will open new growth opportunities

Over the following five years, wireless networks would experience severe congestion due to the availability of technology that allows high bandwidth. This would accelerate the transition to 5G from the current 3G and 4G LTE technology. The 5G technology is anticipated to provide aggregate data rates substantially quicker than the current 3G and 4G data rates. The use of high-bandwidth RF components in wireless networks, such as front-end modules (FEM), power amplifier modules (PAM), antenna switch modules (ASM), RFID modules, and local interconnect network (LIN) transceiver SiP modules, would present design difficulties due to the need to simulate multiple chips, passive circuits, and interconnects all at once in a single package. In turn, this would present a chance for SiP-based RF component producers to participate in designing cutting-edge 5G infrastructure.

Challenges

Challenges

- Effective supply chain management will pose a significant challenge for the market

The SiP market has significant challenges with supply chain management since the business does not lend itself to a "one size fits all" strategy. The market thus requires a solid and clearly defined supply chain. Since SiP is a developing market, several supply chain operations, including logistics and the breakdown and traceability of goods and services, are not standardized. A single foundry might not be able to provide every kind of die needed for the heterogeneous packaging, necessitating the use of several vendors and the associated logistics.

Segmentation Analysis

Segmentation Analysis

The global system in the package sip technology market has been segmented into packaging technology, packaging method, and end-users.

Based on packaging technology, the worldwide system in the package sip technology market is segmented into 2D IC packaging, 2.5D IC packaging, and 3D IC packaging. According to packaging technology, the 2.5D IC packaging category led the market in 2021. One of the main factors contributing to the expanding use of 2.5D packaging in memory chips and smartphones is its lower cost, low power consumption, high-speed signal processing, and small form factors. High thermal performance is another key attribute driving the global 2.5D integrated circuit packaging industry.

Based on the packaging method, the worldwide system in the package sip technology market is segmented into wire bonds and flip chips. According to the packaging method, the wire bonds segment led the market in 2021. The wire bonding segment is anticipated to grow significantly because of the soaring demand from the semiconductor packaging sector, microelectronics, and micro-electro-mechanical (MEMs) systems.

Based on end-users, the worldwide system in the package sip technology market is segmented into consumer electronics, automotive, telecommunications, industrial systems, aerospace and defense, and others. The automobile segment led the market in 2021, according to end users. Technological developments are now affecting the automobile sector. Future forecasts predict a rise in demand for semiconductors used in electronics. The march towards electric cars necessitates significantly lighter cars, which can be accomplished by connecting low-weight components. Manufacturers in the automobile sector are getting ready for tomorrow's difficulties with the help of a robust packaging solution.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 14,952.5 Million |

Projected Market Size in 2028 |

USD 25,774.9 Million |

CAGR Growth Rate |

9.5% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Jiangsu Changjiang Electronics Technology Co. Ltd., Chipmos Technologies Inc., Powertech Technologies Inc., Ase Group, Amkor Technology Inc., Fujitsu Ltd, Toshiba Corporation, Renesas Electronics Corporation, Samsung Electronics Co Ltd, Qualcomm Inc., and Others |

Key Segment |

By Packaging Technology, Packaging Method, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- The Asia Pacific dominated the system in the package sip technology market in 2021

During the forecast period, the Asia Pacific region is anticipated to have the most significant share of the SiP market. SiP technology is growing in demand from consumer electronics, especially smartphones and tablets. As a result, the system in the packaging market in the Asia Pacific is being driven by large firms in this industry, such as Samsung Electronics (South Korea) and Sony (Japan). With its status as an electronic center, China is the most significant contributor to the Asia Pacific Market. Electronic packaging has a sizable development potential because of the industry's mass manufacturing and manufacture of electrical components and electronics goods, which uphold high quality and performance standards. The consumer electronics demand is also significantly boosted by the region's growing population and rising disposable income, boosting the region's electronic packaging business even faster.

Competitive Landscape

Competitive Landscape

Key players within the global System in Package (SiP) Technology market include

- Jiangsu Changjiang Electronics Technology Co. Ltd.

- Chipmos Technologies Inc.

- Powertech Technologies Inc.

- Ase Group

- Amkor Technology Inc.

- Fujitsu Ltd

- Toshiba Corporation

- Renesas Electronics Corporation

- Samsung Electronics Co Ltd

- Qualcomm Inc.

The Global System In Package (SiP) Technology Market is segmented as follows:

By Packaging Technology

By Packaging Technology

- 2D IC Packaging

- 2.5D IC Packaging

- 3D IC Packaging

By Packaging Method

By Packaging Method

- Wire Bond

- Flip Chip

By End User

By End User

- Consumer Electronics

- Automotive

- Telecommunication

- Industrial System

- Aerospace and Defense

- Others

By Region

By Region

-

North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Jiangsu Changjiang Electronics Technology Co. Ltd.

- Chipmos Technologies Inc.

- Powertech Technologies Inc.

- Ase Group

- Amkor Technology Inc.

- Fujitsu Ltd

- Toshiba Corporation

- Renesas Electronics Corporation

- Samsung Electronics Co Ltd

- Qualcomm Inc.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors