09-Aug-2022 | Facts and Factors

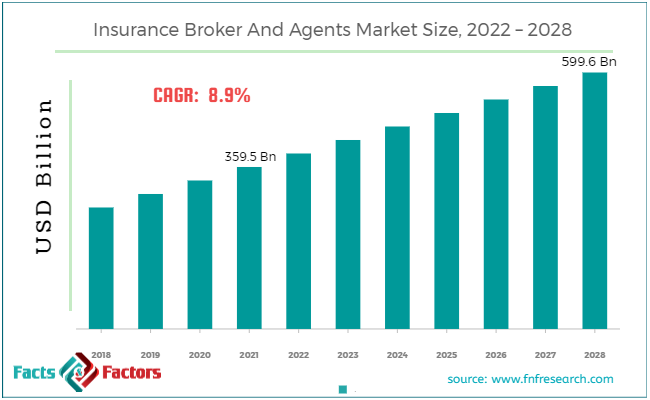

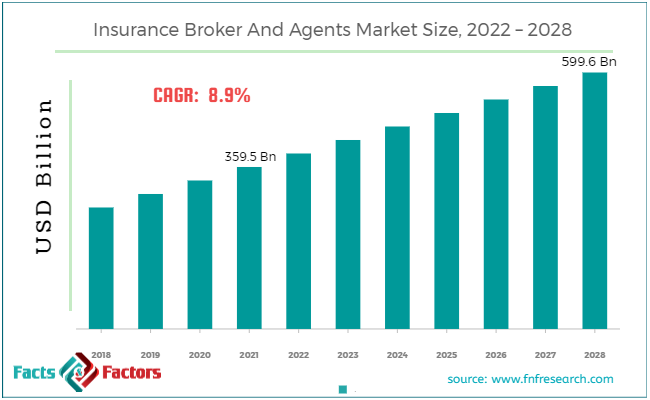

According to Facts and Factors, the global insurance broker and agents market size was worth USD 359.5 billion in 2021 and is estimated to grow to USD 599.6 billion by 2028, with a compound annual growth rate (CAGR) of roughly 8.9% over the forecast period. The report analyzes the insurance broker and agents market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the insurance broker and agents market.

An insurance broker is a critical link between policyholders and insurers and contributes significantly to economic progress. Insurance brokers give their clients specialized information regarding different insurance packages. Medical insurance, property & casualty insurance, and health insurance are insurance products offered by brokers.

Browse the full “Insurance Broker And Agents Market Size, Share, Growth Analysis Report By Type (Insurance Agencies, Insurance Brokers, Bancassurance, Other Intermediaries), By End User (Corporate, Individual), By Mode (Online, Offline), By Insurance (Life Insurance, Property And Casualty Insurance, Health And Medical Insurance), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/insurance-broker-and-agents-market

To meet their client's demands for coverage, insurance brokers collaborate closely with them. Since they identify appropriate terms, conditions, and prices and make recommendations on the insurance policy that best suits their needs, insurance brokers act as consumer advocates. A person who sells insurance products on behalf of an insurance company is known as an agent. There are typically two categories of such agents who approach potential customers who could be interested in purchasing insurance. Both independent and captive or exclusive agents fall under this category.

The main drivers of the growth of the insurance broker and agents industry are the rising demand for insurance policies, the integration of IT and analytic solutions, and the provision of expert solutions and services. With its many benefits to the end user, including guaranteed income, a good return on investment, death benefits, tax advantages, and others, the insurance broker and agents market is anticipated to grow significantly during the projection period. Government initiatives regarding insurance policies and technology integration into current product and service lines are also anticipated to create profitable opportunities for the insurance broker and agents market over the forecast period. Additionally, the market's expansion is hampered by client direct insurance policy purchases and the abundance of alternative platforms for insurance policy sales.

Segmental Overview

The global insurance broker and agents market is segregated based on type, end-user, mode, insurance, and region. Based on type, the market is divided into insurance agencies, insurance brokers, bancassurance, and other intermediaries. The bancassurance segment dominated the market in 2021. Based on end-user, the market is divided into corporate and individual. In 2021, the individual category acquired the largest share. Based on mode, the market is divided into online and offline. In 2021, the online sector will control the market. Based on insurance, the market is divided into life insurance, property and casualty insurance, and health and medical insurance. In 2021, health and medical insurance dominated the market.

Regional Overview

The global insurance broker and agents market is divided into geographic regions: North America, Latin America, Europe, Asia Pacific, Middle East, and Africa. North America dominated the insurance brokerage market in 2021, and it is anticipated that it will continue to do so throughout the forecast period. The presence of significant players who assist customers in finding affordable house insurance, travel insurance, and health insurance is one of the main drivers driving the market's growth in this region. Additionally, many insurance brokers in the U.S. and Canada invest in cutting-edge technology to increase their market share and customer retention. With the rapid uptake of mobile telematics technology by insurance companies in developing countries like China and India, Asia-Pacific is predicted to experience significant growth throughout the projected period. The region's developing economies' rapidly expanding middle class is driving up insurance demand. The region's life insurers are shifting away from fee-based products and protection-based ones, emphasizing accident and health insurance.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 359.5 Million |

Projected Market Size in 2028 |

USD 599.6 Million |

CAGR Growth Rate |

8.9% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Chubb Limited, Marsh & McLennan, Arthur J. Gallagher & Co., Jardine Matheson, Toyota Motor Corp, Hub International, Bank of China, Brown & Brown, Willis Towers Watson, BB&T Insurance Holdings Inc., and Others |

Key Segment |

By Type, End User, Mode, Insurance, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Key Players Insights

The report contains qualitative and quantitative research on the global insurance broker and agents market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts.

Key players in the global insurance broker and agents market include Chubb Limited, Marsh & McLennan, Arthur J. Gallagher & Co., Jardine Matheson, Toyota Motor Corp, Hub International, Bank of China, Brown & Brown, Willis Towers Watson, and BB&T Insurance Holdings Inc.

Recent Development:

- In March 2020, Aon, a UK-based multinational professional services company, purchased Willis Towers Watson for $30 billion. Aon sells a variety of financial risk-mitigation solutions, such as pension administration, insurance, and health insurance plans. The acquisition enabled Aon to provide clients services in areas like intellectual property, cyber, and climate risk.

The global insurance broker and agents market is segmented as follows:

By Type

- Insurance Agencies

- Insurance Brokers

- Bancassurance

- Other Intermediaries

By End User

By Mode

By Insurance

- Life Insurance

- Property And Casualty Insurance

- Health And Medical Insurance

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: sales@fnfresearch.com

Web: https://www.fnfresearch.com

English

English French

French German

German