17-Aug-2022 | Facts and Factors

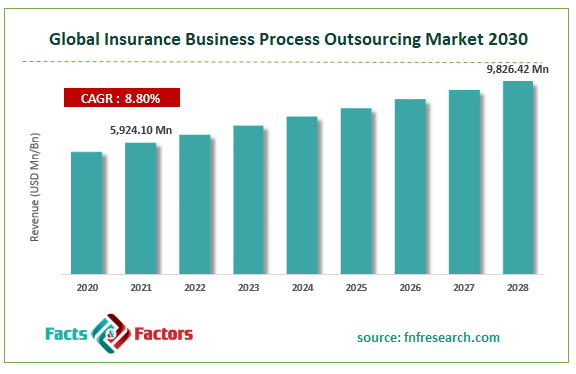

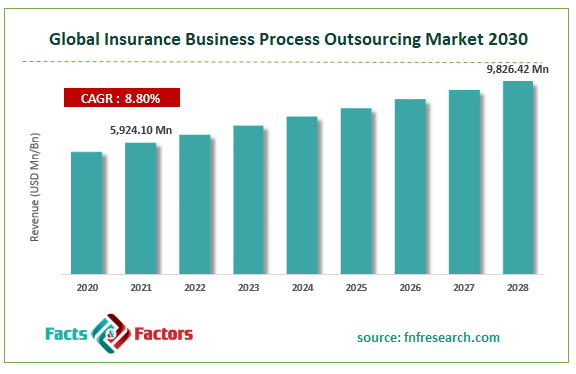

According to Facts and Factors, the global insurance business process outsourcing market was worth USD 5,924.10 million in 2021 and is estimated to grow to USD 9,826.42 million by 2028, with a compound annual growth rate (CAGR) of approximately 8.80% over the forecast period. The report analyzes the insurance business process outsourcing market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the insurance business process outsourcing market.

Insurance business process outsourcing is contracting a certain business function to the specialized outsourcing service provider. Some companies outsource some of their back-office tasks such as bookkeeping, data entry, accounting, commerce support services, digital marketing services and billing services of third-party service providers, and the task is completed under a defined service level. Insurance business process outsourcing is considered a valuable option for those companies that find it difficult to hire experienced staff and manage in-house departments.

Browse the full “Insurance Business Process Outsourcing Market Size, Share, Growth Analysis Report By Deployment Type (On-Premise, & Cloud), By Organization Size (Large Enterprise, Small And Medium Enterprises), By Outsourcing Type (Call Center Service, Data Processing Service, Outsourcing Service, Underwriting Service, And Accounting Service), By Project Types (Life and Annuity policy Services, Property and Casualty Policy Services/Claim Services, and Pension Services), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/insurance-business-process-outsourcing-market

Insurance institutes must successfully manage their core business functions to achieve their targets. Many insurance firms have found that business process outsourcing helps companies be better equipped with the necessary infrastructure, modern insurance technology, and talented experts. An increase in demand for cost-effective operations and the need for business processes among organizations is expected to boost the insurance business process outsourcing market during the forecast period. The global insurance business process outsourcing market report provides a holistic evaluation of the market. Moreover, the insurance business process outsourcing market during the forecast period and increasing demand to manage stringent regulatory compliances effectively is a major factor projected to boost the market in the forecast period.

Based on organization size, insurance business process outsourcing is classified into large enterprises and small and medium enterprises; the indicator is measured as the number of employees in the manufacturing sectors. Such as large enterprises that employ 250 or more people, small enterprises with 10 to 49 employees and medium size enterprises with 50 to 249 employees. Among these large enterprises, segment dominates in the organization size segment due to the high number of employees available in the large enterprises. Based on outsourcing type, insurance business process outsourcing is classified into call center service, data processing service, outsourcing service, underwriting service and accounting service. During the forecast period, the outsourcing service segment dominates the market as many industries adopt outsourcing services, such as the telecom and e-commerce industry, due to this outsourcing service segment dominating the market. Based on deployment type, insurance business process outsourcing is classified into on-premise and cloud. The cloud segment is expected to dominate in the deployment type segment due to the high storage capacity and internet connectivity availability, which supports the market growth during the forecast period.

The Europe region dominates the market in revenue generation. Europe dominates the insurance business process outsourcing market due to increasing the demand for cost-effective operations need for business process outsourcing. In addition, the presence of many big automotive and aerospace companies raises the demand for insurance services which is expected to drive the market growth during the forecast period in the European region. Moreover, the rapid adoption of advanced technologies and government initiatives to encourage business outsourcing also help drive the region's market growth. Therefore, these factors are expected to support the market expansion in the European region.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 5,924.10 Million |

Projected Market Size in 2028 |

USD 9826.42 Million |

CAGR Growth Rate |

8.80% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Accenture, Capita, Cognizant, EXL, Genpact, HCL Technologies Limited, Infosys Limited, Insuserve-1, Sutherland, WNS (Holdings) Ltd., Wipro Limited, and Others |

Key Segment |

By Deployment Type, Organization Size, Outsourcing Type,Project Types, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some main competitors dominating the global insurance business process outsourcing market include Accenture, Capita, Cognizant, EXL, Genpact, HCL Technologies Limited, Infosys Limited, Insuserve-1, and Sutherland, WNS (Holdings) Ltd., and Wipro Limited.

Recent Development:

- In November 2021, the Competition Commission of India (CCI) approved HDFC Life Insurance's acquisition of 100% shareholding in Exide Life Insurance. The move is expected to strengthen HDFC Life's position in South India.

Insurance Business Process Outsourcing is segmented as follows:

By Deployment Type

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By Types of Outsourcing

- Call Center Services

- Data Processing Services

- Outsourcing Services

- Underwriting Services

- Accounting Services

By Project Types

- Life and Annuity policy Services,

- Property and Casualty Policy Services/Claim Services

- Pension Services

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com