09-Aug-2022 | Facts and Factors

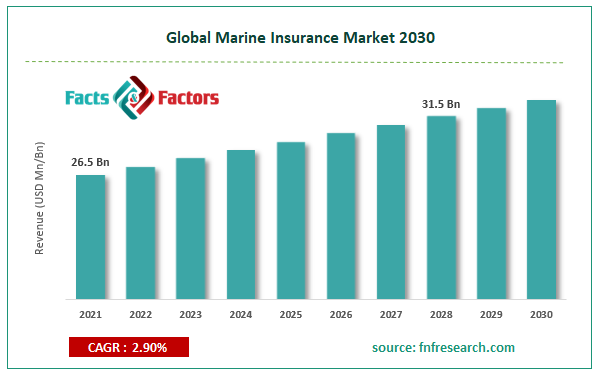

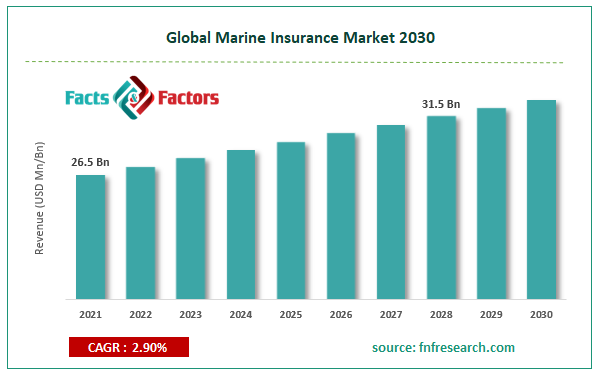

According to Facts and Factors, the global marine insurance market size was worth around USD 26.5 billion in 2021 and is estimated to grow to about USD 31.5 billion by 2028, with a compound annual growth rate (CAGR) of approximate

ly 2.90%over the forecast period. The report analyzes the marine insurance market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the marine insurance market.

Marine insurance coverage aids in risk management in unfortunate events, including damage to property and the environment, accidents, and fatalities. Ship owners, cargo owners, and charterers typically use marine insurance policies. A marine insurance policy offers financial protection against losses and damages incurred during transit to cargo ships, terminals, and ships. Meeting tight regulatory compliance of various countries is typically required throughout import and export trade proceedings. Many insurers are now offering policies that protect against the risk of theft, malicious damage, shortages, and non-delivery of goods. Customers' unique business requirements might be considered when creating these arrangements. They also cover losses brought on by fire, explosions, hijackings, accidents, collisions, and overturning. Owing to the rise in demand for Marine Insurance, the global Marine Insurance market is estimated to grow at a CAGR of 2.90% during the forecast period.

Browse the full “Marine Insurance Market Size, Share, Growth Analysis Report By Type (Cargo Insurance, Hull & Machinery Insurance, Marine Liability Insurance and Offshore/Energy Insurance), By Distribution Channel (Wholesalers, Retail Brokers and Others), By End User (Ship Owners, Traders and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/marine-insurance-market

As a result of government agencies in many countries establishing initiatives to boost domestic industry and international commerce, the number of export activities globally is rapidly rising. A necessity for boats used for commercial transportation is marine insurance. This is one of the main reasons for the demand for maritime insurance, which guards goods or cargo against unforeseen catastrophes while in transit. To streamline cross-border product transportation and reach a broader customer base, e-commerce companies are embracing maritime shipping.

Along with the new online purchasing trend brought on by rapid urbanization, rising income levels, and the growing influence of social media, this hastened the market's growth. Leading companies emphasize integrating machine learning (ML) and artificial intelligence (AI) to supply risk management services, enhance renewal effectiveness, and identify behavioral characteristics affecting real-time loss incidents. It is anticipated that these developments will increase the demand for marine insurance. Numerous laws, rules, and regulations pertaining to insurance services, data privacy, and cyber-security that need further certification, digital security, licenses, and technical support may hinder the maritime insurance market. Strong potential for demand in developing nations has attracted domestic and international suppliers, raising market competitiveness.

Segmental Overview

The global marine insurance market is segregated based on type, distribution channel, end-user, and region. Based on type, the market is divided into cargo insurance, hull &machinery insurance, marine liability insurance and offshore/energy insurance. Among these, the cargo insurance segment dominated the market in 2021. Based on the distribution channel, the market is divided into wholesalers, retail brokers and others. Among these, the broker's segment dominated the market in 2021. Based on the end-user, the market is divided into ship owners, traders and others. Over the forecast period, the ship owners segment is expected to develop fastest in 2021.

Regional Overview

The global marine insurance market is divided into geographic regions: North America, Latin America, Europe, Asia Pacific, Middle East, and Africa. Europe dominated the global marine insurance market in 2021due to the projected expansion of the region's commercial potential. Due to the positive effects of maritime transportation on the European market, it is projected that the industry in this area will expand. Europe is encircled by water, which promotes marine trade and propels market expansion. Major businesses in the marine insurance market have opportunities due to the development of trade agreements globally and the operations of import and export. The demand for waterborne transportation is expanding, and import and export activity is picking up, which has led to an increase in the number of ship owners, helping the nation's marine insurance market.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 26.5 Billion |

Projected Market Size in 2028 |

USD 31.5 Billion |

CAGR Growth Rate |

2.90% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Allianz, AXA, Chubb, American International Group Inc., Arthur J. Gallagher & Co., Aon plc, Lloyd's, Lockton Companies, Marsh LLC, Zurich, and Others |

Key Segment |

By Type, Distribution Channel, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Landscape

The report contains qualitative and quantitative research on the global marine insurance market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts.

Key players in the global marine insurance market include Allianz, AXA, Chubb, American International Group, Inc., Arthur J. Gallagher & Co., Aon plc, Lloyd's, Lockton Companies, Marsh LLC and Zurich.

Recent developments:

- In October 2020 –Seguradorasunidas S.A. and the service firm advance care were acquired by Assicurazioni Generali S.p.A. from calm eagle parent holdings II S.àr.l. and calm rvagle Holdings S.à r.l.in Portugal.

- In April 2020, Tokiomarine established a corporate venture capital (CVC) fund to support local and international early-stage entrepreneurs. It is anticipated that the Palo Alto-based CVC fund will invest between $500,000 and $3 million in seed and series projects in various industries, including finance, healthcare, insurtech, mobility, automation, climate tech, cybersecurity, and artificial intelligence.

Global Marine Insurance Marke is segmented as follows:

By Type

- Cargo Insurance

- Hull & Machinery Insurance

- Marine Liability Insurance

- Offshore/Energy Insurance

By Distribution Channel

- Wholesalers

- Retail Brokers

- Others

By End User

- Ship Owners

- Traders

- Others

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: sales@fnfresearch.com

Web: https://www.fnfresearch.com

English

English French

French German

German