Search Market Research Report

Nordic Treasury Software Market Size, Share Global Analysis Report, 2019 – 2027

Nordic Treasury Software Market By Deployment Mode (On-Premise and Cloud-Based), By Organization Size (Large Enterprises and Small & Medium-Sized Enterprises), and By Vertical (Banking, Financial Services, & Insurance (BFSI), Healthcare, Manufacturing, Consumer Goods, and Chemicals, Metals, & Energy): Industry Perspective, Comprehensive Analysis, and Forecast 2019 – 2027

Industry Insights

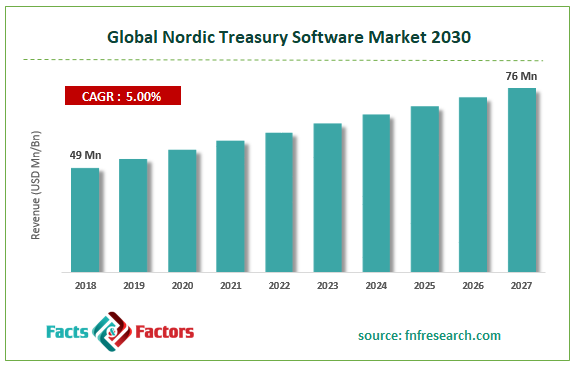

The report covers the forecast and analysis of the Nordic treasury software market. The study provides historical data from 2015 to 2018 along with a forecast from 2019 to 2027 based on revenue (USD Million). The study includes drivers and restraints of the Nordic treasury software market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the Nordic treasury software market.

In order to give the users of this report a comprehensive view of the Nordic treasury software market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product & service launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

The study provides a decisive view of the Nordic treasury software market by segmenting the market based on the deployment mode, organization size, vertical, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2019 to 2027. The regional segmentation includes the current and forecast demand for Nordic Countries.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2018 |

USD 49 million |

Projected Market Size in 2027 |

USD 76 million |

Growth Rate |

CAGR 5 % |

Base Year |

2018 |

Forecast Years |

2019-2027 |

Key Market Players |

Calypso, CRISK Software ApS, Escali Financial Systems AS, Exidio ltd. (Trezone), HCL Technologies Limited, Infor, ION (Reval), Kyriba, Mitigram, MORS Software, SAP SE, SimCorp A/S, Treasury Systems, and ZenTreasury Ltd. among others. |

Key Segment |

By Deployment Mode, By Organization Size, By Vertical |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Breakthroughs in the treasury management software including cloud-based deployment and managed solutions will enhance the market scope over the forecast timeline. Nevertheless, the increase in the number of data breaches coupled with a low level of awareness about the advantages offered by the product can retard the growth of the industry during the forecast timeline. Furthermore, the rise in the trade taking place between the Nordic countries has increased rapidly over the period. However, different trading partners in myriad regions have different currencies, and their value experiences fluctuations as a result of globalization. This will further inhibit the overall market surge during the forecast timeline.

Based on the deployment mode, the market is sectored into On-Premise and Cloud-Based. In terms of organization size, the market is divided into Large Enterprises and Small & Medium-Sized Enterprises, On the basis of vertical, the market is classified into Banking, Financial Services, & Insurance (BFSI), Healthcare, Manufacturing, Consumer Goods, and Chemicals, Metals, & Energy.

Competitive Analysis

Competitive Analysis

- Calypso

- CRISK Software ApS

- Escali Financial Systems AS

- Exidio ltd. (Trezone)

- HCL Technologies Limited

- Infor

- ION (Reval)

- Kyriba

- Mitigram

- MORS Software

- SAP SE

- SimCorp A/S

- Treasury Systems

- ZenTreasury Ltd. among others.

Industry Major Market Players

- Calypso,

- CRISK Software ApS,

- Escali Financial Systems AS,

- Exidio ltd. (Trezone),

- HCL Technologies Limited,

- Infor,

- ION (Reval),

- Kyriba,

- Mitigram,

- MORS Software,

- SAP SE,

- SimCorp A/S,

- Treasury Systems,

- ZenTreasury Ltd.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors