Search Market Research Report

Aerospace Composites Market Size, Share Global Analysis Report, 2022 – 2030

Aerospace Composites Market Size, Share, Growth Analysis Report By Matrix Type (Ceramic Mix, Polymer Mix, and Metal Mix), By Manufacturing Process (Resin Transfer Molding, AFP / ATL, Filament Winding, Lay-Up, and Others), By Fiber Type (Glass Fiber Composites, Carbon Fiber Composites, Glass Fiber Optics, and Others), By Aircraft Type (Military Aircraft, Civil Helicopter, Commercial Aircraft, Business & General Aviation, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 – 2030

Industry Insights

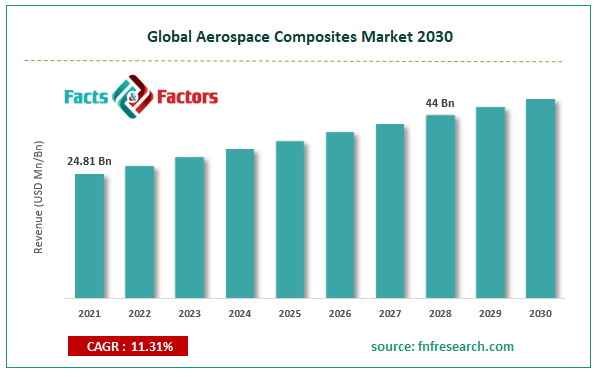

[216+ Pages Report] According to the report published by Facts Factors, the global aerospace composites market size was worth around USD 24.81 billion in 2021 and is predicted to grow to around USD 44 billion by 2030 with a compound annual growth rate (CAGR) of roughly 11.31% between 2022 and 2030. The report analyzes the global aerospace composites market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the aerospace composites market.

Market Overview

Market Overview

Since the inception of the aerospace industry, constant efforts have been made to manage the weight ratios of any aircraft since it is an important factor that defines the efficiency and effectiveness of the airplane. The growing innovation in the use of composites to build aircraft parts is a result of these efforts. The use of composites can help the players in the aerospace industry overcome the barriers that emerge when metals are used in the manufacturing process. Since composites can significantly reduce the weight of the aircraft, they have found multiple structural applications amongst all types of aircraft ranging from space shuttles to hot air balloons used for entertainment purposes.

Composites are predominantly plastics with a reinforcement of carbon fibers. Essentially, composites are made of 2 or more phases or their constituent parts. Due to the flexibility offered by composites, they can be molded in various shapes which in turn helps to increase their turn. Fibers can be applied to these shapes from all directions which allows designers to create structures with specific and unique properties.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global aerospace composites market is estimated to grow annually at a CAGR of around 11.31% over the forecast period (2022-2030)

- In terms of revenue, the global aerospace composites market size was valued at around USD 24.81 billion in 2021 and is projected to reach USD 44 billion, by 2030.

- The market is projected to grow at a significant rate due to the increasing investments in space exploration activities

- Based on matrix type segmentation, the polymer mix was predicted to show maximum market share in the year 2021

- Based on fiber type segmentation, carbon fiber composites were the leading resin in 2021

- On the basis of region, North America was the leading revenue generator in 2021

Growth Drivers

Growth Drivers

- Increasing investments in space exploration to drive market growth

The global aerospace composites market is projected to grow owing to the increasing interest and simultaneous investment in space exploration as a means to emerge as the next super powerful nation, especially in current politically volatile global situations where power dynamics seem to be shifting between the western and the eastern countries. Space exploration and related activities have always been a part of furthering technological growth but now the national and private space agencies have the necessary resources, information, tools, and funds to increase the total investment required to make breakthrough discoveries.

One of the major projects many economies are working toward is exploring life on other planets and finding ways of possibly relocating mankind to another globe as a means to avoid complete extinction. SpaceX, a leading US-based spacecraft manufacturer, and satellite communications giant launched in 2002, has by far managed to raise more than USD 9 billion in total funding. In January 2015, Alphabet was recorded to have invested USD 900 million when the company was valued at USD 12 billion. The company is invested in building a crew base on Mars with an extended surface presence which the company hopes to grow into a self-sustaining colony.

Restraints

Restraints

- Performance failures in fibers to restrict the market growth

Although composites are used significantly in the aerospace industry and are known to perform exceptionally well, carbon fiber-reinforced polymers (CFRP) are prone to malfunction in multiple cases. One such example is the fracture of the fiber which also includes fiber rupture when loaded under extreme tension. The fiber may also start to kink when exposed to compressive stress. All these factors can lead to a considerable loss in the load-carrying capacity of the aircraft. Composite materials are known to be highly sensitive to defects that are likely to occur during the manufacturing process.

Opportunities

Opportunities

- Aggressive innovation for the development of new composites to provide expansion opportunities

As aerospace composites continue to deliver exceptional performance and have consistently proven to be of high importance in the aerospace industry, the most dominating market players like Airbus and Boeing have started aggressive campaigns to develop new types of composites including thermoplastic composites fabrication and resin infusion. These companies have increased the production of aircraft for instance the Irkut MS-21 by United Aircraft Corp, which the company plans to manufacture 60 to 100 units per month.

Challenges

Challenges

- Growing fatal accidents in commercial flights to challenge market growth

In recent times, the number of aircraft-related accidents has increased considerably. Although various factors can be associated with the reason behind the malfunctioning of the aircraft, such incidents are known to hamper the entire demand and supply chain for suppliers and manufacturers. In 2021, around 8 commercial airplanes crashed with fatal results. As per estimates, an average of 75 to 85 planes crash every year. This poses a major challenge for the global market players to overcome as the demand for commercial flights may dip.

Segmentation Analysis

Segmentation Analysis

The global aerospace composites market is segmented based on matrix type, manufacturing process, fiber type, aircraft type, and region

Based on matrix type, the global market divisions are a ceramic mix, polymer mix, and metal mix. In 2021, the global market was led by the polymer mix owing to the high applications of carbon fiber-reinforced polymers in the manufacturing of commercial aircraft. The carbon fiber used in the manufacturing process helps to provide the necessary stiffness and strength to the final structure. These fibers originate from organic polymers where 90% of carbon fibers are made from polyacrylonitrile (PAN) process

Based on fiber type, the global market divisions are glass fiber composites, carbon fiber composites, glass fiber optics, and others. Carbon fiber was the leading revenue generator in 2021 as it is one of the most widely used fiber types in the aviation industry. The toughness, strength, resistance to extreme conditions, and corrosion are some of the main reasons for the popularity of carbon fiber. These composites are flexible and hence can be molded in desired shapes with ease which other fiber types may not be able to provide. Boeing 787 Dreamliner is made using 50% composite material by weight.

Recent Developments:

Recent Developments:

- In July 2021, Markforged launched two new composites for use in the aerospace industry. The new products are called Carbon Fibre FR-A and Onyx FR-A and were launched after undergoing analysis by the National Institute for Aviation Research (NIAR)

- In October 2022, Velocity Composite, an aerospace supplier, launched a digital manufacturing cell to ease the process of traceability.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 24.81 Billion |

Projected Market Size in 2030 |

USD 44 Billion |

CAGR Growth Rate |

11.31% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2030 |

Key Market Players |

Solvay Group, Toray Industries Ltd., SGL Group, Teijin Limited, Hexcel Corporation, Koninklijke Ten Cate BV, and others. |

Key Segment |

By Matrix Type, Manufacturing Process, Fiber Type, Aircraft Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the market growth in years to come

The global aerospace composites market is projected to witness the highest growth in North America, with the US leading with the highest regional market share. The growth is expected to be driven by the increasing use of aerospace composites in the growing aviation sector in the US as well due to the presence of some of the largest aircraft manufacturers in the region. The Boeing Company, one of the giants in the aerospace industry is housed in the US.

The company is a major supplier of not only commercial airplanes but also has a strong foothold in the satellites, rockets, rotorcraft, and missile segment. The US military and aviation giant has recently announced its intention to increase its research & development capabilities in the Indian market by investing USD 200 million. The US also has the largest global network as it caters to consumers across 6 continents.

Competitive Analysis

Competitive Analysis

- Solvay Group

- Toray Industries Ltd.

- SGL Group

- Teijin Limited

- Hexcel Corporation

- Koninklijke Ten Cate BV.

The global aerospace composites market is segmented as follows:

By Matrix Type Segment Analysis

By Matrix Type Segment Analysis

- Ceramic Mix

- Polymer Mix

- Metal Mix

By Manufacturing Process Segment Analysis

By Manufacturing Process Segment Analysis

- Resin Transfer Molding

- AFP / ATL

- Filament Winding

- Lay-Up

- Others

By Fiber Type Segment Analysis

By Fiber Type Segment Analysis

- Glass Fiber Composites

- Carbon Fiber Composites

- Glass Fiber Optics

- Others

By Aircraft Type Segment Analysis

By Aircraft Type Segment Analysis

- Military Aircraft

- Civil Helicopter

- Commercial Aircraft

- Business & General Aviation

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Solvay Group

- Toray Industries Ltd.

- SGL Group

- Teijin Limited

- Hexcel Corporation

- Koninklijke Ten Cate BV.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors